|

3PLs FACE CHALLENGE: SELLING INTANGIBLE

Warehousing marketing maven Kenneth B. Ackerman believes warehouse

operators can meet the challenge of "branding and selling an intangible" if

they can identify and market the "special magic" that sets them

apart from competitors.

Speaking March 26 at the annual convention of the International

Warehouse Logistics Association (IWLA) on Miami Beach, Ackerman

pointed to the 2003 gathering's title -- "Keeping the Wind in

Your Sales" -- and commented, "The real key thing in this business,

as the conference title implies, is selling.

"There was a time we were selling buildings," Ackerman said, noting

how warehouse owners would take "enormous pride" in presentations

focusing on pictures of their facilities.

"I think we've progressed from that to selling people," continued

Ackerman, who has been in the warehouse and logistics business

since 1957. He served as chairman of Westerville, Ohio-based Distribution

Centers Inc. before becoming a Columbus, Ohio-based consultant

and industry handbook author.

"Anybody can build a building," he said. "The key is to have good

people in it."

The challenge, according to Ackerman, is proving to prospective

-- and current -- customers that these people are "superstars."

"Selling warehousing must start by identifying `special magic,"'

he said. "You must be a star at something. It may not be storage

and handling. It may be inventory, IT (information technology),

packaging, precise delivery... You've got to pick a niche

and establish it."

EXPECTATIONS CITED

Ackerman

listed 11 key customer expectations for

outsourced warehousing that should be taken into consideration

by any provider

in the branding process:

- Perfect shipping, on time, without exceptions;

- Flawless inventory control; - No warehouse damage;

- No theft or mysterious disappearance; -Dependability, with

all promises always kept;

- No surprises;

- Teamwork relationships with truckers;

- Perfect receiving;

- Minimal dock-to-stock time;

- Minimal order cycle time; and

- Ability to easily adapt to special situations.

While he conceded that some of these expectations cannot be 100

percent fulfilled -- "nobody has no warehouse damage unless they're

hiding it!" -- Ackerman said it is important that warehouse operators

do all they can to achieve these objectives and to demonstrate

their efforts and successes to customers and prospects alike.

Part of this process also includes determining what present --

and former -- customers, as well as prospects, think of the warehouse

operator.

"What you think is important is far less critical than what they

think," Ackerman said. "If you are working at branding, you have

to associate your brand with something attractive."

For example, he said, Hamden, Connecticut-based USCO Logistics,

the largest North American network of shared

warehouses, effectively sells both internally and externally its

motto that it has its "House in Order."

BRANDING CLEVER!

Perhaps the cleverest branding in the business, according to Ackerman,

has been done by a Scranton, Pa.-firm that now goes by the official

name of Kane Is Able Inc. The corporate name change was the last

step in a process that began when officials of the Kane family

business responded to a state trucking authority questionnaire

that asked, among other things, if the carrier was "able and fit" - "and

a light came on."

"Of course, what is most important is what Kane does each day

to prove it is able," Ackerman said.

On the other hand, he questioned the effectiveness of UPS - Atlanta-based

third-party logistics (3PL) provider United Parcel Service of

America Inc. -- in using "brown" in its branding. He said he understands

why UPS trucks began being painted brown, to not show road dust,

but, from a marketing standpoint, Ackerman asked, "Why is brown

desirable? It just plain isn't relevant."

It is equally important for favorable "special magic" branding

to be sold within the company as to those outside it, Ackerman

said, commenting, "If you don't, you will soon get very embarrassed."

He termed line-level supervisors and customer service representatives "the

folks who can support your brand or tear it down more than anyone," and

he urged that they be sufficiently trained.

Ackerman said he sees as "the greatest sea change" in the warehousing

and logistics business a recent approach by some manufacturers

to view logistics as "just a form of purchasing." That, he said,

means an executive with neither knowledge nor interest in warehousing

may be making warehousing decisions.

"If that's so, you may be selling your services to an ex-shoe

buyer or an ex-meat buyer," Ackerman said. "So you've got to be

able to go to that ex-shoe buyer and educate them. After all,

branding and selling are forms of teaching."

NAME CHANGE EYED

The IWLA may well be changing its branding soon.

The trade group, which began in 1891 as the American Warehousemen's

Association and five years ago became the International Warehouse

Logistics Association when it added Canadian and Mexican members,

is considering a moniker that better reflects activities of its

membership, according to Gary N. Owen, who assumed chairmanship

of the IWLA at the March convention.

Owen, who is senior adviser for Nashville-based 3PL provider Ozburn-Hessey

Logistics, said, "The old logistics industry is changing. The

customer's demanding a lot more. We truly are no longer just a

warehouse association."

He said a new name is expected to be in place by the group's 2004

convention, set for March 28-31 in Phoenix.

IWLA BUSINESS

OUTLOOK REPORT PUBLISHED

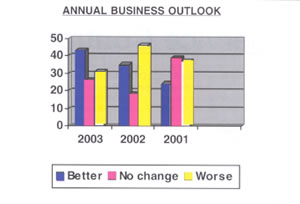

51 percent of respondents project using more space this

year than in 2002. |

While the warehouse logistics industry is experiencing an uptick

in business this year, uncertainty about the overall economy and

world events has resulted in greater pessimism regarding the overall

2003 business climate.

Those results are according to the annual Business Outlook published

by the IWLA. The report was unveiled on March 24 at IWLA's annual

convention in Miami, Fla.

The IWLA study says that 66 percent of members report that their

company is in a growth mode, and 60 percent intend to hire more

employees in 2003.

However, while 60 percent are either cautiously optimistic or

very optimistic about the business climate for 2003, 40 percent

are concerned or very

concerned. Last year, only 29 percent were in that category.

"Clearly, business seems to have rebounded somewhat in 2003, but

with the economy continuing to sputter, executives aren't ready

to say that business has turned completely," says Joel Hoiland,

president and CEO of the IWLA. "There still seems to be a fair

amount of skepticism about what the future has in store."

The results were based on a 30-question survey sent to IWLA's

550 members in March. Aside from the positive results concerning

business growth, the survey also reveals gains in space utilization

for 2003. Just over half (51 percent) of respondents project using

more space this year than in 2002. And while 35 percent projected

using less space last year, only 15 percent fall into that category

in 2003.

The other bright spot is that 43 percent of IWLA members say business

is better this year as opposed to last year, while 26 percent

say business is the same (see bar chart). However, nearly one-third

(31 percent) claim business is off from last year. The results

are marginally better than last year, when nearly half of respondents

(46 percent) said business was down, with only 35 percent claiming

an increase.

Increasing costs continue to be a concern, especially when it

comes to insurance. Sixty percent of respondents expect

health insurance costs to increase greatly, while another 37 percent

expect slight increases. Almost all respondents (93

percent) also expect some sort of increase in property insurance.

Members also anticipate costs hikes for utilities and transportation. Increasing costs continue to be a concern, especially when it

comes to insurance. Sixty percent of respondents expect

health insurance costs to increase greatly, while another 37 percent

expect slight increases. Almost all respondents (93

percent) also expect some sort of increase in property insurance.

Members also anticipate costs hikes for utilities and transportation.

"We see some good trends, especially in the fact that so many

of our members expect to hire more employees this year," says

Hoiland. "That in itself is a good indicator of growth. We're

excited that space utilization is heading in the right direction

and that so many of our members project to be in a growth mode."

The study also shows that 36 percent of IWLA members are concerned

with the financial status of their top 20 customers, and that

85 percent expect pressure from customers to reduce prices while

increasing services. Sixty-five percent plan to purchase technology

in 2003. Forty-one percent plan a major equipment purchase this

year. Half of those respondents expect their capital expenditure

to be less than $250,000.

IWLA, the outsourced logistics association, promotes the growth

and success of 3PL companies by providing its members resources,

information, education and professional programs designed to advance

their business and provide greater value to their customers.

|